With tax season behind us, you might be staring at a pile of tax forms, receipts, and financial documents and wondering, “Do I still need all of this?” Properly managing your tax documents is essential — not only for your peace of mind, but also to protect yourself in case of an audit.

Knowing what to keep and for how long helps you reduce clutter and avoid the risks associated with misplaced or discarded sensitive information. In this guide, we’ll cover which documents to keep, how long to keep them, the exceptions to the rules, and how to dispose of them securely.

Which Tax Documents Should You Keep?

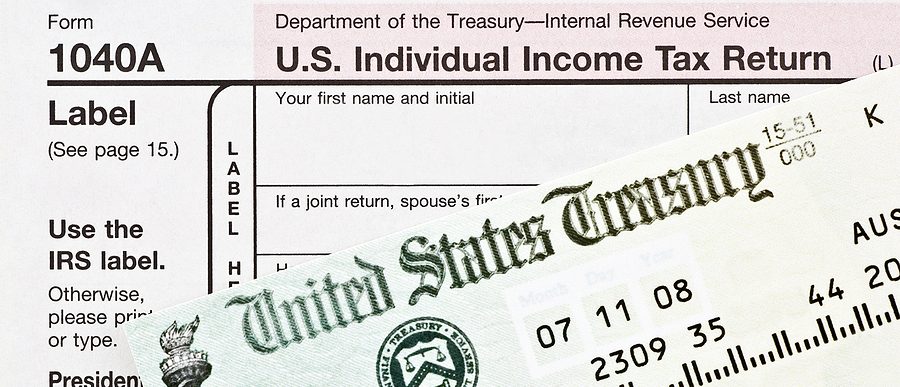

In the event of an audit, the Internal Revenue Service (IRS) may request documentation to verify deductions, income, loans, and other elements on your return. Generally, it’s recommended to retain records of:

- Income: Forms like W-2s, 1099s, and bank statements are essential.

- Expenses and deductions: Save invoices, receipts, and documentation for alimony, charitable donations, etc.

- Home and property: Keep records of property purchases, sales, and tax assessments.

- Retirement accounts: Important forms include Form 5498, Form 8606, and 401(k) statements.

- Investments: Hold onto transaction data, receipts, and annual statements.

Most documents should be kept for at least three years from the filing date, but some may need to be retained longer depending on specific circumstances.

Exceptions to the Three-Year Rule

The IRS has a general three-year statute of limitations to initiate an audit, but certain situations may extend this period. Here are some exceptions to keep in mind.

IRS Extended Timelines for Audits

- Six-year rule: If you’ve underreported income by 25% or more, the IRS may look back six years.

- Seven-year rule: Claims for bad debt deductions or worthless securities extend the retention period to seven years.

- No statute of limitations: If you haven’t filed a return or submitted a fraudulent one, the IRS can audit you indefinitely.

Note that each state has its own statute of limitations for audits, typically ranging from four to five years. Check your state’s guidelines to ensure compliance with local record-keeping requirements.

Tax Records to Dispose of After One Year:

- Pay stubs that have been reconciled with your W-2 forms

- Monthly brokerage statements that have been verified against annual statements and 1099 forms

Tax Records to Dispose of After Six Years

- 1099 forms and business expense receipts (if you receive multiple 1099 forms, as this increases the likelihood of income underreporting)

- Foreign financial assets records

Tax Records to Dispose of After Seven Years

- Records related to worthless securities or bad debts

Tax Records to Keep Indefinitely

- Asset records (such as stocks, bonds, and property) should be kept until the statute of limitations has expired following the sale.

- 1040 forms and related schedules can be essential for future loan applications and financial assistance requests.

How to Safely Dispose of Tax Documents

Once your documents are no longer needed, secure disposal is crucial. Tax records contain sensitive personal information, so throwing them in the trash can leave you vulnerable to identity theft. Here’s how to handle tax document disposal safely:

- Shred your documents. Use a reliable shredding service to ensure sensitive data is destroyed.

- Choose a convenient shredding method. Mobile shredding involves a shredding truck that comes directly to your location so you can watch your documents being shredded. Ship ‘N’ Shred allows you to mail in your documents to be shredded on your schedule, offering flexibility for smaller projects.

By securely shredding your documents, you reduce the risk of identity theft and ensure compliance with IRS recommendations.

Digital vs. Physical Record Storage

As more people shift to digital recordkeeping, storing tax documents electronically can be an efficient alternative to managing piles of paper. Digital records are also valid for IRS audits as long as they’re easily accessible and legible. Here are a few tips for secure digital record storage:

- Organize by tax year: Label files clearly by year and category (e.g. “2023_Tax_Returns”) to simplify retrieval if needed.

- Scan and save: Use a reliable scanner to digitize important documents.

- Back up files: Store files in a secure, encrypted location, like a cloud service with robust security measures or an external hard drive.

Shred Nations Is Your Trusted Partner for Tax Document Disposal

At Shred Nations, we understand the importance of secure, hassle-free shredding. Whether you’re clearing out years of tax documents or need ongoing shredding solutions, we provide convenient and affordable services nationwide. With options like mobile shredding that brings security to your doorstep, and Ship ‘N’ Shred for flexible disposal on your timeline, we make protecting your information as simple as possible.

Properly managing and disposing of tax documents helps protect your personal information and provides peace of mind. Let Shred Nations be your go-to partner for secure disposal so you can confidently check one more item off your list, knowing your data is safe. Reach out today at (800) 767-3365 for free, no-obligation quotes from our trusted shredding partners.